Multi-asset investment solutions

Building long-term wealth

Human Financial is an Australian investment manager, owned and operated by professionals with decades of global experience, successfully steering investments through economic cycles.

Our focus is clear: helping our investment clients achieve their long-term objectives. We do this through offering well-constructed, diversified, multi-asset portfolios. And we apply the tools, disciplines and intelligence of institutional investing to cut through daily market noise and concentrate on the real levers of long-term wealth creation.

Outcomes-based investing

Human Financial manages 14 established multi-asset model portfolios, each designed to align with specific investment objectives and risk profiles.

For targeted exposures, our single asset-class managed funds provide the flexibility to capture specific opportunities, or to add tailored tilts to investors’ core portfolios.

“We have successfully used the Human Financial Managed Portfolios for many years because they do what they say they’ll do. While delivering growth, stability and sound active management, they also always keep an eye on downside capital protection.

“This has allowed us to focus more on individual client strategy, the thing that most clients truly value. Importantly, their approach has helped to keep our clients invested throughout changing market cycles, meaning they are way ahead from day one.”

— Jason Poole, Managing Director GPA Financial Services

Deep experience

The Human Financial team is dedicated to supporting investors and their advisers at every step of their wealth journey. We integrate deep experience across investment management, operations, client service, distribution, governance, risk and technology.

This breadth of expertise allows us to design and implement robust investment strategies, supported by strong operations, disciplined oversight and responsive service.

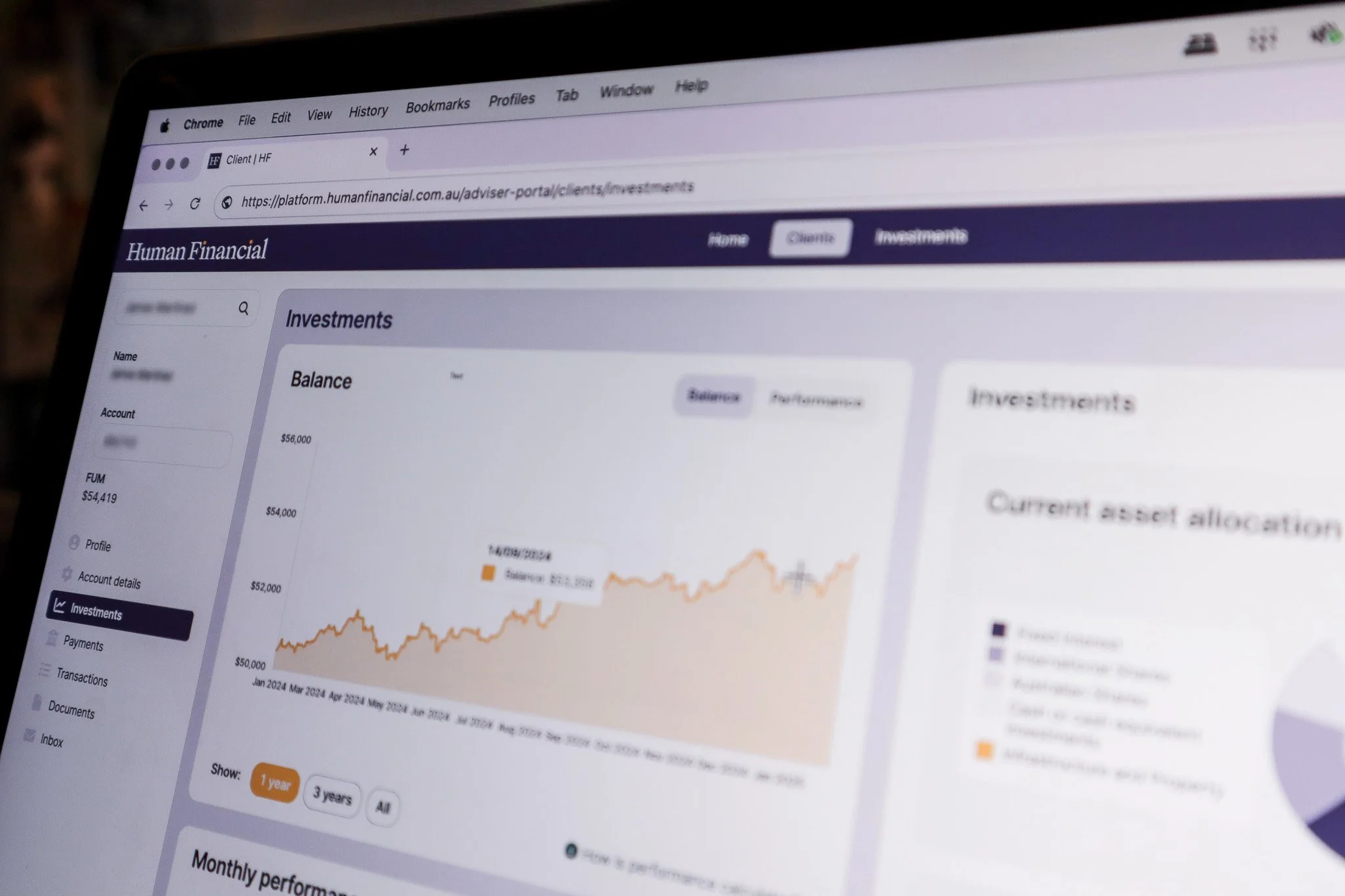

Proprietary technology

Human Financial’s investment platform is underpinned by powerful proprietary technology, including our investment management systems, and intuitive online portals for wealth advisers and customers.

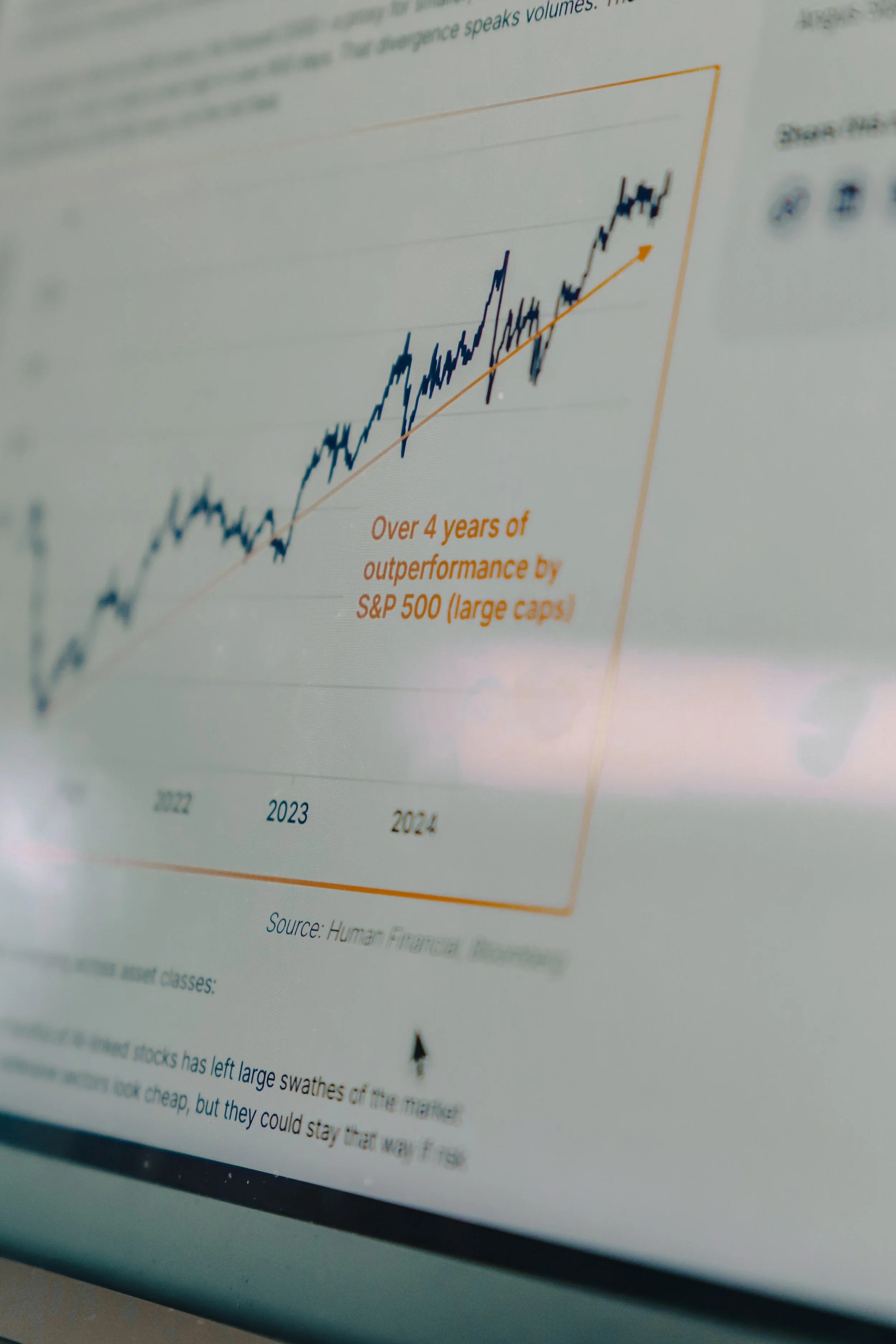

Investment insights

Rational decision-making is founded on thorough analysis grounded in experience. At Human Financial we share our investment insights through webinars, regular analytical insights and macro-economic updates.

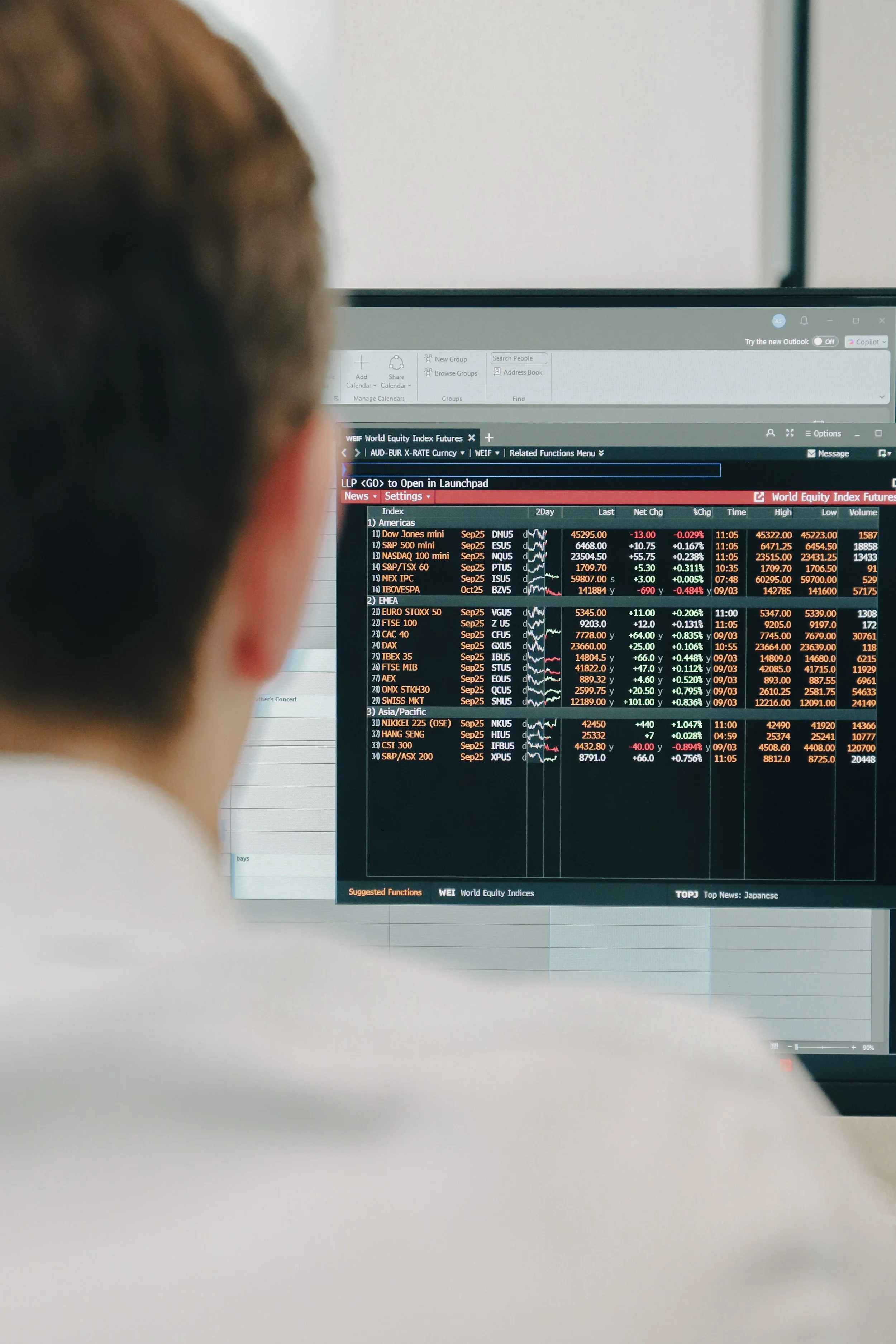

Market Briefs

Human Financial’s Market Briefs offer succinct commentary on current financial, economic and geo-political commentary issues.

Market Reviews

Monthly Human Financial Market Reviews scan significant market developments, providing fresh insights and spelling out implications for portfolio positioning.

Adviser Webinars

Monthly CIO Insights webinars provide financial advisers with an opportunity to explore emerging themes in financial markets, and their implication for portfolio management.