Spooky September

In financial markets September is notorious for delivering negative seasonality performance. This unattractive characteristic is usually attributed to northern hemisphere investors reassessing their investment portfolios after returning from their summer holidays Their conclusions are often less than optimistic, leading to increased selling that in turn drives prices lower. Last month was no exception, logging the second worst September month equity returns (behind 2022) in the last decade.

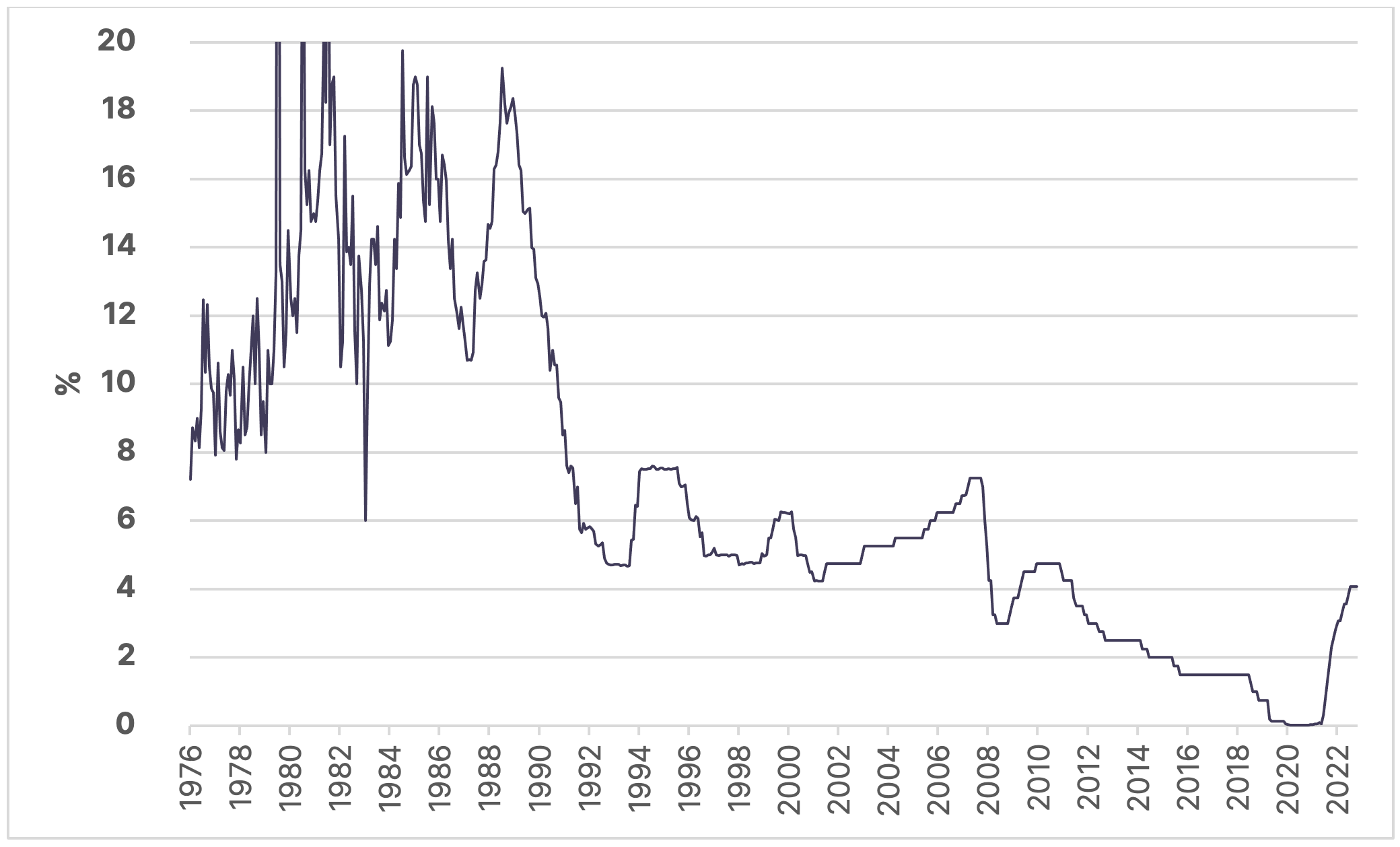

The driver of the negative returns wasn’t that central banks had aggressively hiked rates, it was the realisation that interest rates are likely to stay at current levels for longer. We’ve been saying this for a while now: viewed over multiple decades, interest rates are only back to ‘normal’ levels. This is especially true here in Australia where interest rates are still below levels witnessed prior to 2008.

Figure 1. Australian Interest Rates

Our rationale for continued higher interest rates can be summarized by the following two factors:

Factor 1: Strong economic data. While we see warning signs that economies are overheating, for now they continue to run ‘hot’, especially in the US. Economic data continues to beat estimates, with the index used to measure such data strength remaining at the higher end of its decade-long range. This strength will increase the likelihood that central bankers will need to further lift interest rates in a bid to avoid the economy from really overheating.

Figure 2. Economic data continues to beat expectations (Source: Bloomberg, Citi)

Factor 2: Renewed inflationary pressure. Future expectations of inflation have risen recently, primarily driven by the +28% Q3 rally in the oil price, to back above US$90/barrel. While central bankers do exclude energy prices from their inflation measures, medium-term inflation expectations are increasingly suggesting that investors expect elevated prices to continue.

Figure 3. Expected level of inflation over the next 5 years continues to rise (Source: Bloomberg, The Federal Reserve Bank of St. Louis)

Equities on the down elevator

In terms of September’s market performance, the US led the major equity indices lower with the S&P 500 posting a -4.8% return, eradicating more than a quarter of its YTD gain. Domestically, the ASX 200 was -2.8% lower, eradicating >40% of its YTD return. As the saying goes in financial markets, you take the stairs up and the elevator down. Sector-wise, the worst performer was the listed real estate sector which fell -7.8% while major champions of the US, the IT and consumer discretionary sectors were down -6.9% and -6.0% respectively. The US energy sector posted a positive 2.5% return on the month, rounding out a strong quarter +11.3%. This was driven by decreased OPEC+ oil supply outlook and higher expected oil demand from the US, which most expect to rebuild its strategic reserves. It was a similar story in Australia, with REITs falling -8.7% followed by technology dropping -7.9%, while only energy delivered positive returns of 2.0% for September.

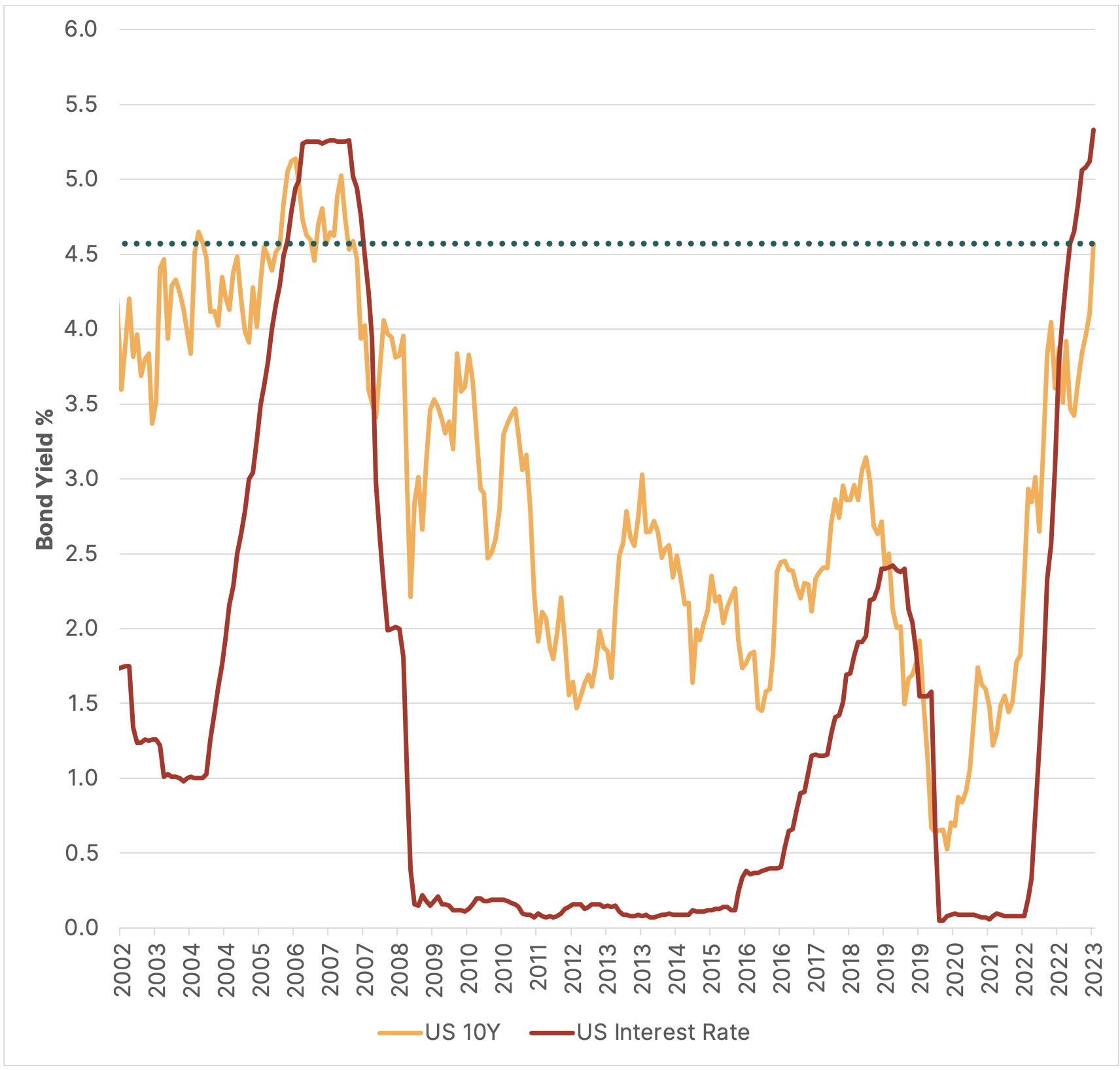

Higher for longer leads bonds lower

The same fears of “higher for longer” led fixed income markets lower during September, worsening Q3 losses across major government bond markets. Australian bonds fared a bit better since earlier in the quarter yields had not suffered as much as other international bond markets, thus limiting their Q3 selloff to the 46 basis points experienced in September (yields up = prices down). While continued bond market losses do create challenges in terms of shorter-term investment decisions, we do remain positive on the medium to longer-term outlook as the higher the yield, the more income protection we receive in future. The US 10-year government bond yield has now increased to levels not seen since before the GFC, climbing towards the higher end of their yield range experienced from 2003-08. This enables investors to receive a material ‘risk-free’ return. This in turn increases the hurdle required to invest in riskier assets like equities.

Figure 4. US government bond yields back to pre-GFC levels

USD stands strong

In currency markets, the combination of higher expected future US interest rates led to further US dollar strength. Until September, the European currencies of GBP, EUR and CHF were the strongest performers; however, this reversed significantly over the month with GBP & CHF now holding onto modest YTD gains. AUD fared better potentially due to higher iron ore prices over the month but remains one of the weaker major currencies for 2023. We remain unhedged across our international equity portfolios, which is a helpful stabilizer in periods of weakness as AUD has historically underperformed insulating losses on international assets when translated back to AUD.