Sleep soundly, but avoid the hangover

In this article:

High interest rates make fixed income investments more attractive

There’s growing focus on term deposits, but they carry reinvestment risk

Investment-grade corporate bonds offer an additional option, with lower reinvestment risk downside

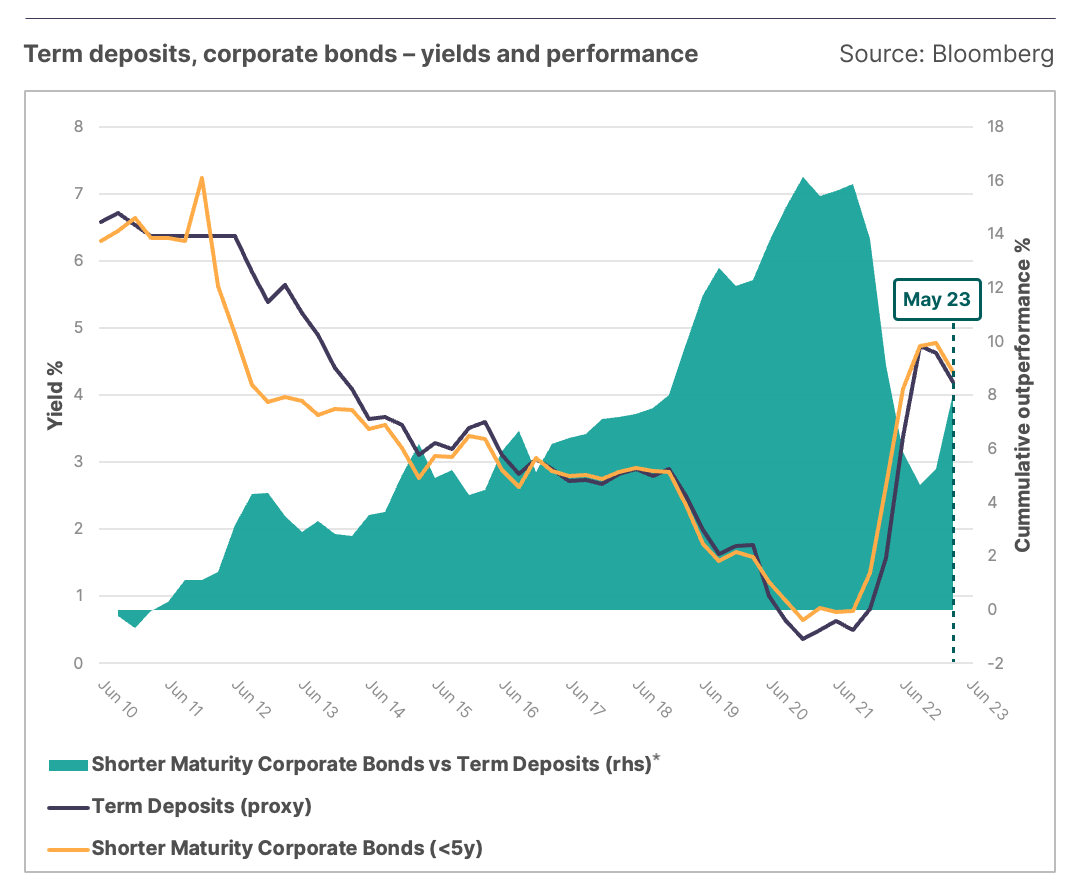

Term deposits yield versus corporate bond yield (graph)

Estimated reading time: 2-3 mins

Like wine, term deposits help you to sleep deeply, but they can cause longer-term headaches for investment portfolios. Short-dated investment-grade corporate bonds can be a useful remedy.

Investing in a high interest rate environment

One of the benefits of higher interest rates is that fixed income investments become more appealing, particularly term deposits. Right now, these instruments are generating income at levels not seen in the past decade.

Term deposits are exactly what the name implies: a deposit for a certain period of time (a ‘term’), typically between one month and five years. The longer the term, the higher the interest rate offered to the depositor by authorised deposit-taking institutions (ADIs), which prefer the stability of longer-term deposits. Term deposits are accessible, easy to use and offer a great way to park savings for shorter periods in exchange for a higher savings rate. Many investors include term deposits in their portfolios for the ‘sleep-well factor’ – you’ll rarely lose any sleep worrying whether they’ll eat into your savings.

About term deposits

Term Deposits are offered by authorised deposit-taking institutions (ADIs), which are licensed by the Australian Prudential Regulatory Authority to carry out banking activities, including accepting deposits from the public. ADIs include banks, building societies, and credit unions.

Under the Australian government-backed Financial Claims Scheme, any investor who puts up to $250,000 into a term deposit with an ADI is protected from losing their money if that ADI fails.

It’s important to note, however, that early withdrawals from a term deposit may incur penalties such as interest rate reductions and break costs, with the size of penalty usually depending on time left until maturity.

And they are not without risk...

While it makes sense to include term deposits in investment strategies, there is a downside, especially when considering shorter-term deposits: reinvestment risk. At the end of your investment term, interest rates may be a lot lower than when you put your savings into the term deposit. This means that if you want to roll over into a new term deposit, you may receive less attractive yields.

There’s another fixed income option

At this point, it’s worth comparing term deposits with another shorter-dated fixed income investment option, namely short-dated (under five years) investment grade corporate bonds.

About corporate bonds

Corporate bonds are issued by companies to raise additional funds for their normal business activities, or for a specitic objective such expansion or an acquisition.

Each company receives a credit rating based on the fundamental health of their business. This reflects the likelihood of default on repayments.

In the event of bankruptcy, bond holders are generally repaid before equity owners.

Using the broad index of bonds available in Australia compared to a proxy for one-year term deposits, it’s clear both have mostly generated similar yields since 2010. However, when you look at the relative performance, corporate bonds have done better (as shown in the graph below).

This is because corporate bonds benefit from the capital gains potential that is inherent in the way they are priced. In other words, yields fall when the price of a bond grows, and this generates a capital gain on the original investment purchase price. While corporate bonds are also susceptible to reinvestment risk, when interest rates fall their price appreciates, providing additional growth for investors. The result is a larger capital amount to reinvest at a lower rate.

The graph below shows the relationship between interest rates, bond yields and term deposit rates, reinforcing a widely held view that the best time to invest in bonds is after interest rates have risen. As such, we currently believe that fixed income exposure in investment portfolios is a desirable component to consider in combination with other income providers. Our view is premised on the worsening economic outlook, as well as market expectations that the Reserve Bank of Australia is nearly at its interest rate ceiling and is predicted to start cutting rates in the next 12 months.

Within our fixed income fund that is exactly how we are positioning: towards shorter-dated exposures which are already at attractive yields, but will also benefit from any future drop in interest rates.