Everything everywhere all at once

Alpha Waymond Wang: We developed an algorithm that calculates which statistically improbable action will place you in a universe on the edge of your local cluster, which then sling shots you to the desired universe.

Evelyn Wang: That doesn’t make any sense!

Alpha Waymond Wang: Exactly. The less sense it makes, the better.

November delivered strong returns across the universe of assets as investors digested lower inflation numbers, emerging with a renewed belief that interest rates have not only peaked, but will swiftly revert lower: nearly two 0.25% rate cuts have been priced into the USA for Q2 next year.

Within equity markets the US continued its momentum. The Nasdaq 100 and S&P 500 indices returned 10.8% and 9.1% respectively over the month. The Euro Stoxx and Nikkei indices also delivered strong returns of 8.0% and 8.5% respectively. Emerging markets (5.3%) and ASX 200 (5.0%) returns were also positive, if somewhat lower, held back by China exposures and fears. Within US sectors, technology once again led the November gains with a return of 12.7%; all other sectors were positive, apart from energy which was down -1.6%. Within ASX sectors, the story was rather different, with a more pronounced reversal in the underperforming sectors of healthcare and REITs, which rallied 12.3% and 11.8%, while consumer staples, utilities and energy sectors delivered negative returns of -0.9%, -6.0% and -7.3% respectively.

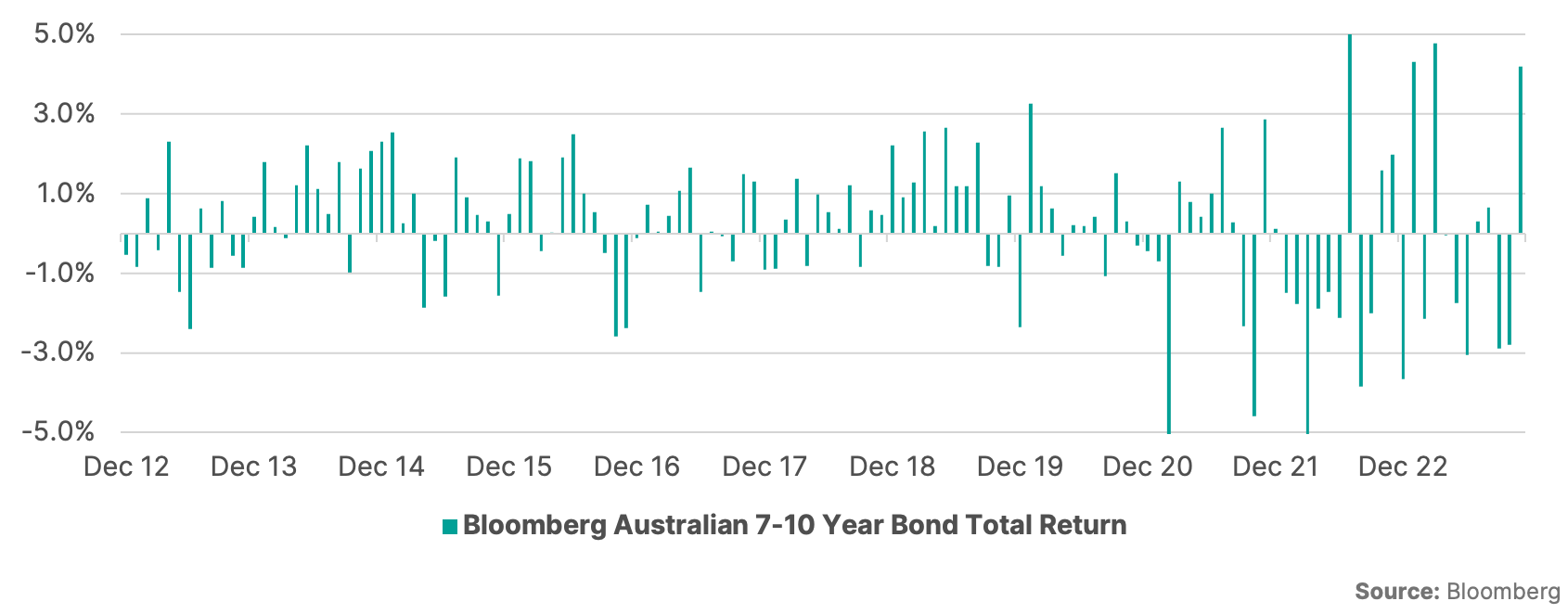

Government bonds also delivered uniformly strong returns during November, with the US 10-year yield falling 0.6%, eclipsed only by New Zealand’s 10-year bond yields, which dropped 0.67%. Australian government 10-year bonds fell 0.51% during the month, equating to a price return of 4.2%, the 4th strongest monthly return in the last decade. Interestingly the only three months with stronger returns were July ’22 (+5.15%), March ’23 (+4.78%) and January ’23 (+4.31%), all of which occurred during the much-debated worst bond bear market in history.

Figure 1. Monthly Australian government bond returns

In currencies, the US dollar was weaker by 3.0%, leading to rallies from most major currencies. The strongest performer (vs USD) was the Swedish Krona (+6.1%) followed by NZD at +5.2%, with the AUD rallying 4.2% during the month.

EEAAO!

What does an ‘everything everywhere all at once (EEAAO)’ rally tell us?

Although all at once everything seems rosy, this is not a sign that we’ve popped into a parallel universe. The strength of markets in November is unsurprising as Q4 is generally the strongest quarter of returns within equity markets, as holiday sales periods drive increased consumption. On top of that asset prices had dipped in the months preceding November: on a 3-month basis many markets are still nursing losses e.g. ASX 200 is at -1.8% and Australian 10-year government bonds are down -1.64%.

Generally speaking, a broad-based rally follows a material decrease in fears across the market. But in this case investors weren’t fearful to start with, given that equity markets were already at, or near to, all-time highs.

So it is probable that the sole driver of November’s EEAAO returns was the belief that interest rates will drop sooner than expected, and that this will solve everything.

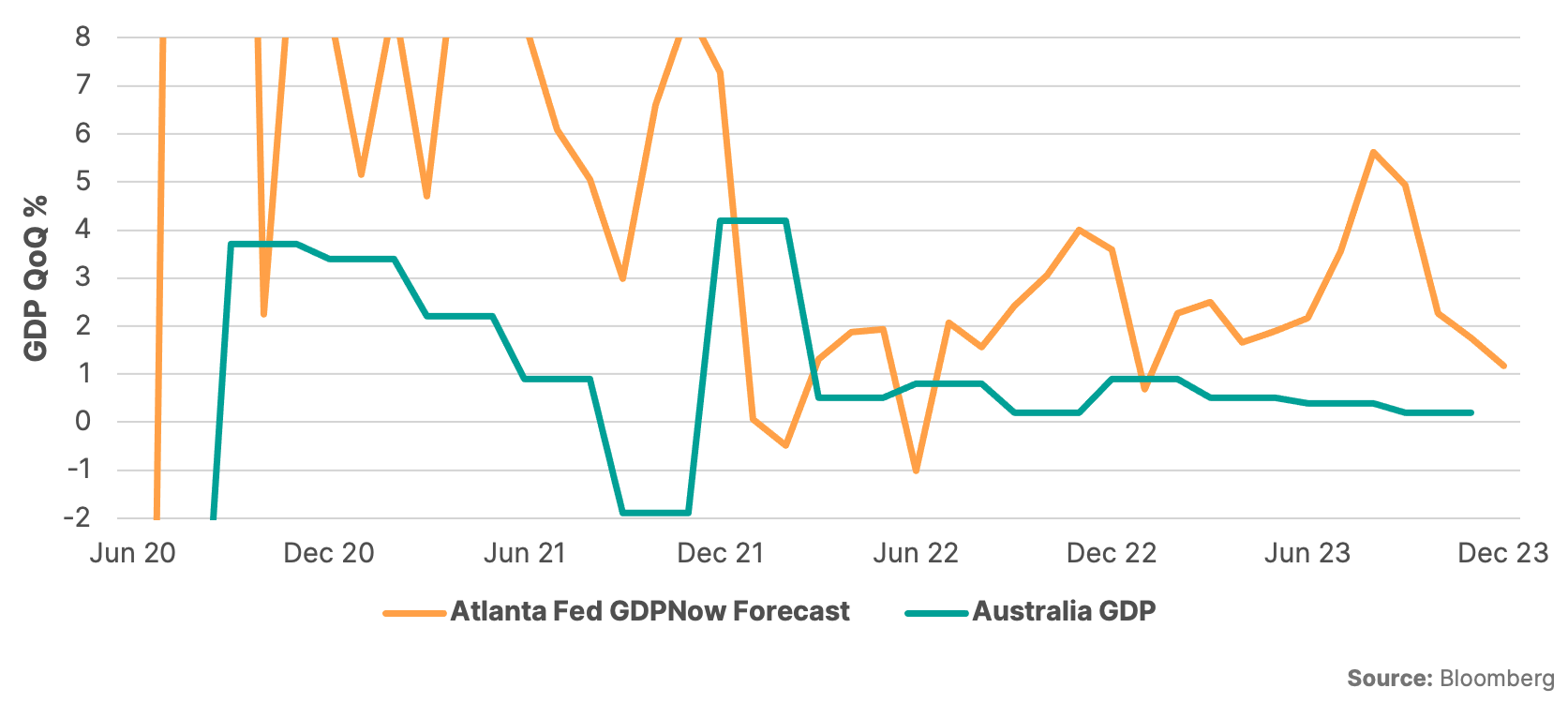

We are more circumspect: in our view interest rates are falling because of the combined impact of a lower inflation expectation and, more importantly, lower growth.

Figure 2. Quarterly growth declining in Australia and the US

Meanwhile, in the real world…

While markets sometimes appear to be operating in a parallel universe, back in the world of work GDP growth is slowing at home and abroad. The Atlanta Fed’s GDPNow forecast of Q4 growth is currently 1.2%, one of its lowest readings in the last year. At home, Australian Q3 GDP was +0.2%, well below expectations of +0.5%; and this number was primarily driven by the government spending on social benefits aimed at alleviating the consumer crisis of high prices. The Australian household savings-to-income ratio fell for the 8th straight quarter, to its lowest level since 2007: clearly not a sign of financial strength.

While we continue to see storm clouds on the horizon and are defensively positioned, we do have a number of exposures that rallied strongly in November: global small cap equities, Australian and global REITs, emerging market equities, and our overweight fixed income allocation. Some of these delivered double digit returns in November, enabling us to capture a higher return despite being underweight equities.

We will continue to position the models accordingly, so as to balance the risks of upside vs capture of downside, until we see the risks subsiding.