Crystal balls don’t tell all

Today, almost every investment professional seems preoccupied with gazing into their crystal ball, trying to predict the timing and pace of interest rate cuts from the Reserve Bank of Australia or the US Federal Reserve. When will they, when won’t they, how much will they, how much won’t they etc., etc. Ultimately, though, no-one – including the central bankers themselves – know for sure what will happen in the future. So it’s important as investors that (a) we don’t place blind faith in policy makers, and (b) we don’t idly sit by, awaiting confirmation of their actions.

Instead, it’s profitable to look beyond the crystal ball, to other promising opportunities. For example, while we’re waiting for the Fed we’re taking another look at emerging market equities.

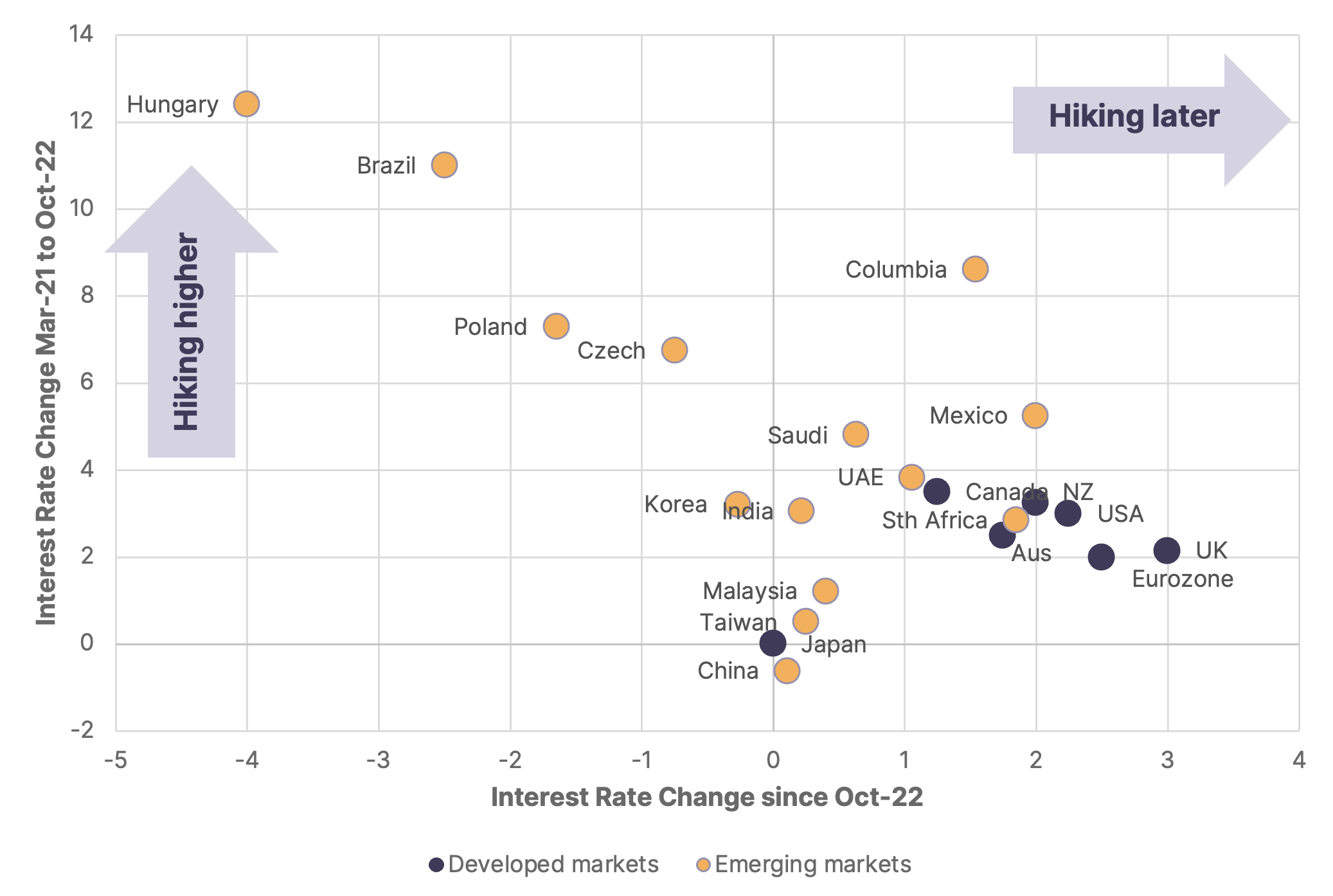

For starters, in 2021-22 most emerging market central banks (EMCBs) started hiking rates much earlier, and increased their interest rates more, than their developed market counterparts. Since then, most EMCBs have slowed their hiking speed considerably, while a number, like Brazil and Hungary, have reversed course and reduced interest rates significantly. There are anomalies of course: China has barely moved its interest rates, and Japan’s Bank of Japan hasn’t changed its interest rate from -0.10% since 2016.

Figure 1. Central Banks interest rate moves (March 2021 to October 2022 vs October 2022 to February 2024)

Source: Human Financial, Bloomberg

While interest rates in emerging markets are generally still higher than developed markets, the post C-19 divergence of central bank policy has meant that the spread between the two has fallen, and in some cases we now see lower interest rates than those determined by the US Federal Reserve. In Figure 2 below it is easy to see that Korea, Taiwan and China all have interest rates significantly lower than the US, while the likes of South Africa and India are at their lowest spread levels in over a decade. Meanwhile the Latam countries of Brazil and Mexico are at the higher end of the spread range but are either stable or contracting. On balance, this suggests that on a relative basis monetary policy is already less restrictive in emerging markets and in some cases may even be stimulatory.

Figure 2. Select emerging market interest rates vs USA

Source: Human Financial, Bloomberg (USA shown as an absolute number)

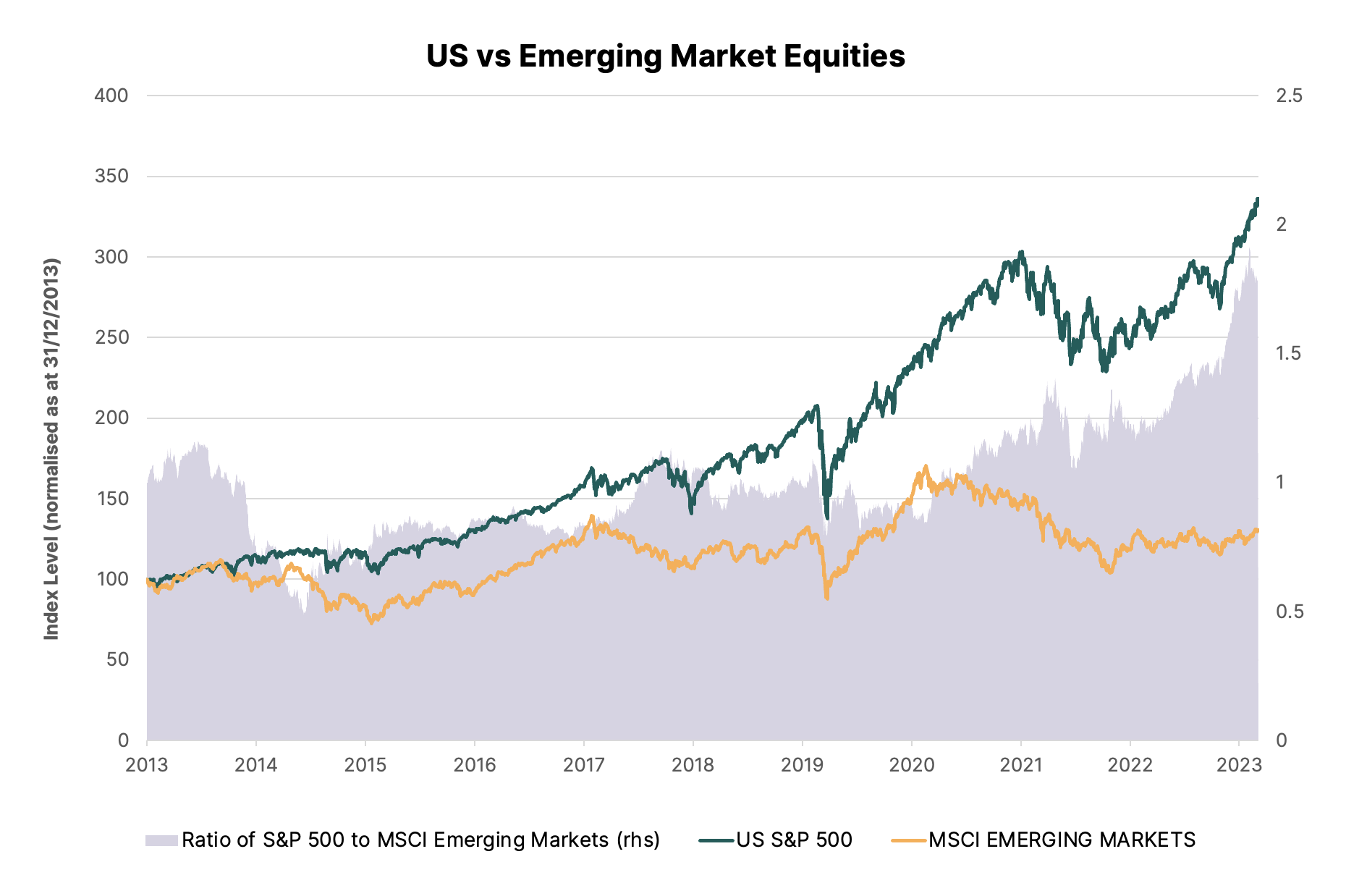

At the same time as policy becomes, potentially, a relative tailwind for emerging markets the entry point for a return to the sector is looking increasingly attractive. We have benefited from our low/underweight allocation, but with the most recent rally in US equities we are again considering whether it is time to be allocating back to this unloved sector.

Figure 3. Emerging and US market equity indices

Source: Human Financial, Bloomberg

One of the elevated risks associated with investing in emerging markets is the potential for changes in government policy: this is especially important for China, which is the largest single country exposure in the MSCI Emerging Market index, at >25%. Recently though, China has been taking positive policy steps to boost growth, increase banking liquidity, and limit the ability of investors to speculate on domestic stocks. The potential impact of such actions is hard to quantify, but if Covid taught us anything it was that large-scale stimulatory government intervention has a meaningful positive impact on markets, especially on those that have been unloved.

Outlook

It seems most investors are only proposing two positive outcomes for 2024: either that growth will be strong or that any weakness will be offset by interest rate cuts. Based on market levels today, we believe the probability of either of these two outcomes remains low, especially with investors seemingly turning a blind eye to potential risks.

While we wait for the mists to clear on US Federal Reserve and Reserve Bank of Australia policy, we are hunting for unloved asset classes in which we see attractive pricing opportunities, for example in emerging markets. We see a better payoff in this unloved sector where broad ownership and allocation levels are low, potentially setting up for elevated returns as emerging markets shrug off the investor fears that have depressed the sector for a number of years.